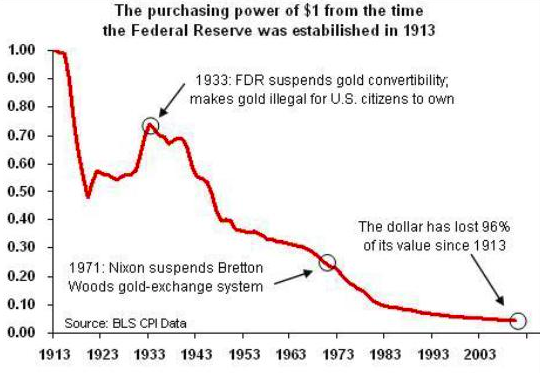

Inflation is an invisible tax on wages and savings.

Inflation is an invisible tax on wages and savings.

The purchasing power of new currency comes from the dilution of our wages and savings.

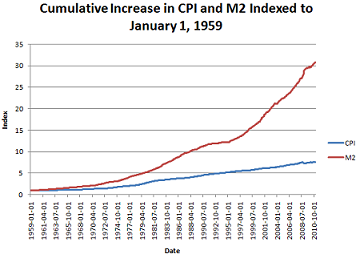

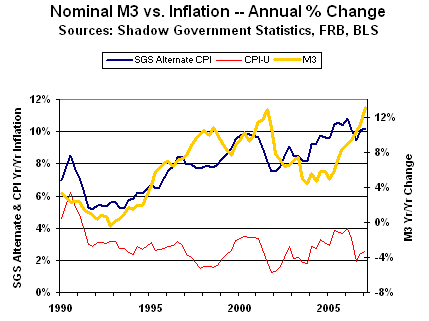

But the inflation of the currency supply is far greater than we think.

We all understand that the increase in consumer prices on the shelves (CPI) erodes our purchasing power, but the real inflation rate is much higher. It is the rate at which the currency is actually increasing.

This real rate of erosion is hidden by our productivity (more work, more throughput, more production, with that same inputs) that makes the difference between CPI and M2/3. We work harder and smarter to keep inflation down, but the benefits do not accrue to us, but rather to the currency creators.

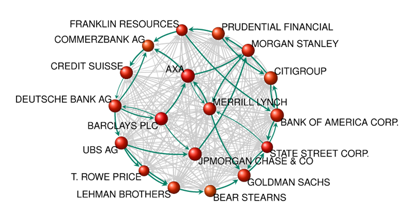

This tax accrues to banks.

The inflation of currency also explains the long term increase in stock prices, since that is where much of it ends up, buying up control of listed companies with created currency.

The Network of Global Corporate Control clearly shows the beneficiaries of this bounty (TARP, QE, etc.) of invisible tax on our savings and wages becomes available to the “supply side” of primary agents (banks).

Note that loans to governments, corporations, and individuals, even though they are created out of nothing and inflate the currency supply, are claims on our labour and assets, and that bankruptcies lead to the expropriation of those assets. They create a loan out of nothing and suddenly have claims on our labour and assets.

Only the currency for the principal is created. Currency to pay interest is not created, thus interest payments come out of the existing currency supply (loans). This inevitably leads to reduction in currency supply, busts, and bankruptcies.

Interest on bonds and savings (which are lent out), contribute (previously created currency) to capital, and are thus useful. Usurious interest is interest imposed when currency is created which cannot be paid back without shrinking the supply, leading to dispossession of the borrower, and unearned income for the banks.

When a loan gets paid down, the principal is extinguished, reducing the currency supply even further, requiring yet more loans (currency) to keep the economy operating.

Governments have to keep borrowing more and more just to make those interest payments, eventually forfeiting pensions, gold reserves, land, and infrastructure to restructuring and austerity. The largest single expenditure at all levels of all governments is interest payments. Governments tax us to pay banks.

Governments are simply another type of organization on the landscape such as the Vatican, or General Motors. While GM sells motorcars and the Vatican sells hope for their income, governments extort their income through tax agencies, courts, police, and incarceration, ie., the largest government agencies exist for coercion. (If government services were valuable, they could sell them without compulsion)

![monte_med_marruecos[1]](https://governingtaxfree.wordpress.com/wp-content/uploads/2018/06/monte_med_marruecos1.jpg?w=739)

Likewise, corporations have to keep growing, churning, and externalizing costs onto labour and the environment to pay for financing. This system needs exponential growth, and new wars (another large government agency) or corporate capitalism dies.

Bureaucratic machinery is devastating the earth, and impoverishing us in the service of banks and bureaucracies.

It is the access to this volcano of currency that empowers a small group to run corporations, bribe politicians, grease bureaucrats, influence courts, pollute our planet, dispossess and enslave humanity, and cause wars (the grandest of thefts).

They suck the life out of governments, corporations, and individuals through interest, inflation, and dispossession, while taking control of them through equity, bribery, and destitution.

While we cannot fight them, we will make them obsolete and irrelevant.

[…] $360 billion currently accrues to private banks (btw, this was the citizens’ dividend that Social Credit […]

LikeLike

[…] We are painfully aware of the severely distorted distribution of wealth on our planet, and how it came about. […]

LikeLike

[…] An invisible tax on wages and savings through inflation […]

LikeLike

[…] invisibly taxed through inflation of the currency, reducing buying power of wages and […]

LikeLike

[…] still invisibly taxed through inflation of the currency, reducing buying power of wages and savings […]

LikeLike

[…] An invisible tax on wages and savings through inflation […]

LikeLike